Overview

ATMs Evolve in the COVID-19 era.

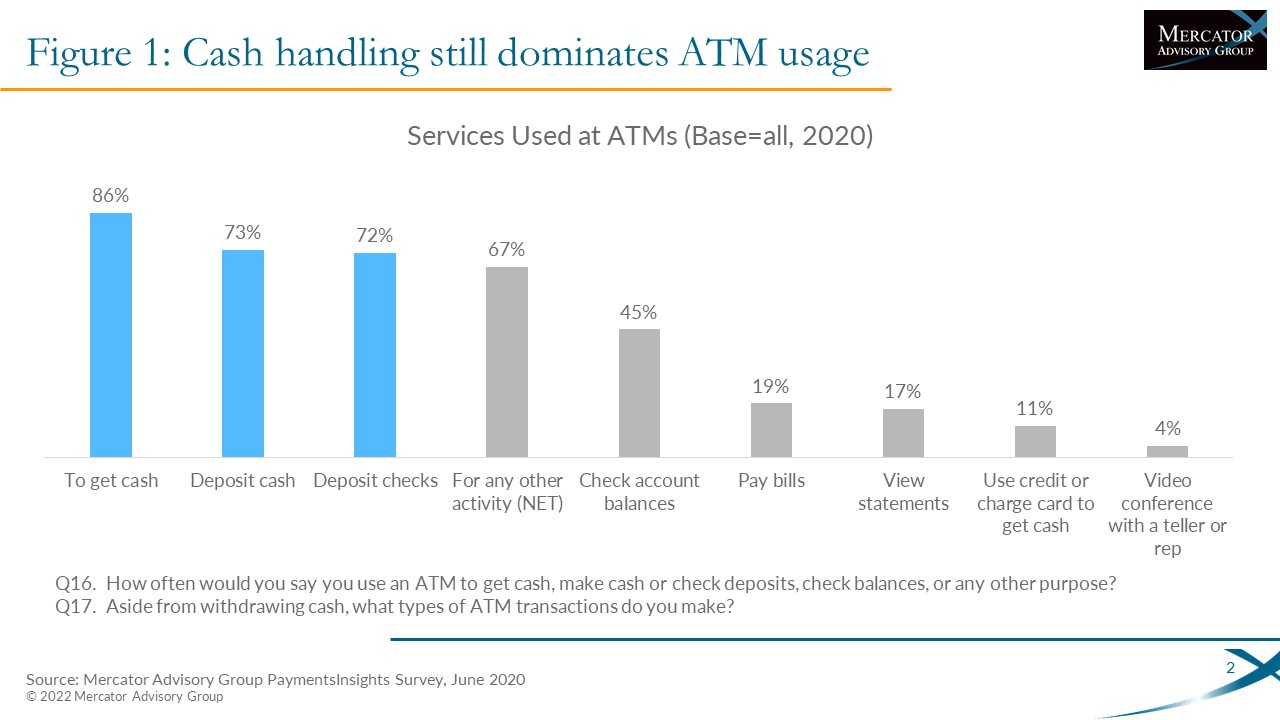

As the COVID-19 pandemic ripples across consumer payments, the heavily cash-centric ATM is in a challenging position. Consumers’ use of cash for daily transactional purposes (purchases, person-to-person payments) is on the decline, although larger amounts are being held at home. At the same time, FIs are rationalizing and reducing their branch networks and revising branch configurations and staffing, putting ATMs in the role of supplementing cash handling in the branch. Enhanced cash-recycling ATMs are being deployed to improve the efficiency of cash management. Simultaneously, the move to smartphone-based digital interfaces—and now the delivery of digital goods, namely cryptocurrencies—provides new opportunities for existing and new terminals. A new research report from Mercator Advisory Group titled 2022 ATM Market Summary: Coping in a New Cash and Digital Era looks at the usage related to the pandemic environment, cash usage that influence how consumers use ATMs, and trends in the design, deployment and new capabilities.

"The pandemic environment teaches us once again that consumer behavior can change overnight. Some of the changes in consumers’ use of cash may slowly revert to earlier patterns, while others are here to stay and further grow," comments Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group and author of the report.

This research report has 24 pages and 16 exhibits.

Companies mentioned in this report include: Federal Reserve Bank of San Francisco, LibertyX, NCR, Venmo, Walmart, Zelle

One of the exhibits included in this report:

- Shifts in behavioral baselines

- Overall ATM and cash usage trends

- ATM surcharging

- Capabilities in a shrinking ecosystem

Learn More About This Report & Javelin

Related content

Room for One More? Global Real-Time Pay-by-Bank Lessons for the U.S.

Pay-by-bank solutions go by a lot of names—bank transfer, bank-to-bank transfer, direct account payment, direct debit, and more—but one thing is clear: When they are ubiquitous, in...

Get Out Your Wallet: Gen Z Debit Payment Preferences

Generation Z—those born from 1997 to 2012—is coming of age and moving steadily toward greater financial maturity. Members of this generation differ from their elders in significant...

Retailer Debit Cards: Why Doesn’t Everyone Do It?

Consumers are on a quest for value and convenient ways to pay. Retailers and merchants want to boost sales and cut costs. These interests can get together through retailer debit ca...

Make informed decisions in a digital financial world