Small Business Credit Cards: Growth Opportunities in a Post-COVID World

- Date:December 30, 2021

- Author(s):

- Brian Riley

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

Small Business Credit Cards: It’s About More than Just Rewards.

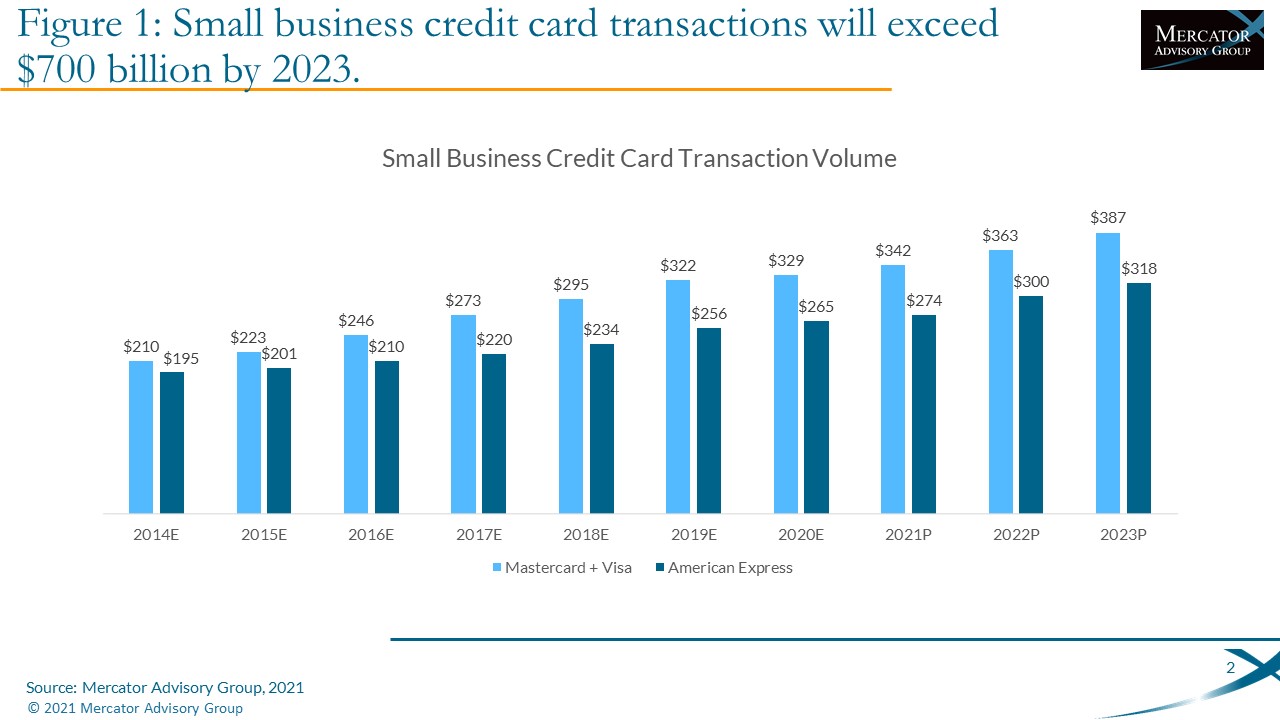

Mercator Advisory Group released a report covering the credit cards issued for small businesses titled Small Business Credit Cards: Growth Opportunities in a Post-COVID World. The research explains current markets, reviews programs offered by top issuers, and suggests that issuers look at four current fintech models to revitalize their view of this rich market. With two thirds of the U.S. GDP driven by small businesses, there is a large audience to harvest. Program designs need to do more than just generate reward points; they need to provide the small business owner with tools to reduce costs, understand their spend, and prepare the small business for growth.

The research explains how fintechs are redefining the small business card space and what traditional issuers need to think about over the next three years.

"Fintech Buy Now, Pay Later should be a learning experience for all credit card issuers,” comments Brian Riley, Director, Credit Advisory Service, at Mercator Advisory Group, and the author of the research note. Riley continues, “You cannot keep doing the ‘same old thing’ or new players will disrupt your model. Small business credit cards are more than just reward generators. Issuers need to keep the product engaging with tools and value-added features.”

This document contains 26 pages and 17 exhibits.

Companies mentioned in this research note include: American Airlines, American Express, Alaska Airlines, Apple, Bank of America, Barclaycard, Bento, Brex, Capital One, Chase, Citi, Costco, Delta Airlines, Discover, FIS, Fiserv, Goldman Sachs, Hyatt Hotels, Jet Blue, Kabbage, Lowes, Marriott, Mastercard, Pex, Southwest Airlines, TSYS, Tribal Credit, U.S. Bank, United Airlines, Visa, Wells Fargo, Wyndham Hotels.

One of the exhibits included in this report:

Small Business Credit Cards: Growth Opportunities in a Post-COVID World

Highlights of the research note include:

- Small business sector description and characteristics

- Card-by-card review of top issuer small business credit cards

- Risks and Opportunities

- Fintechs in the sector

- Selected topics form the Mercator Advisory Group Small Business PaymentsInsights survey

Learn More About This Report & Javelin

Related content

Credit Scoring: A Cornerstone to Credit Extension and Management

The traditional methods of credit scoring—time-tested and statistically sound—remain excellent ways of assessing the creditworthiness of consumers. FICO Score 8, the dominant credi...

High-Yield Savings Accounts: An Efficient Way to Fund Credit Card Loans

Credit card lending requires funding, and banks with credit card programs find themselves at an interesting point: The prime rate is at its highest level in decades, and in anticip...

Credit Card Lending Needs a Slowdown; Work with Cardholders to Shield Upcoming Risk

Consumer debt is climbing, and for the wrong reason. Consumptive spending is evident on credit cards, and household budgets are under stress, diminishing the ability of consumers t...

Make informed decisions in a digital financial world